take home pay calculator madison wi

If you make 70000 a year living in the region of Wisconsin USA you will be taxed 12843. Trends in wages increased by 17 percent in Q3 2022.

Wisconsin Payroll Tools Tax Rates And Resources Paycheckcity

Calculate your take home pay from hourly wage or salary.

. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Use ADPs Wisconsin Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Wisconsin state income tax is a graduated tax which means. 49 rows Wisconsin has a population of just under 59 million 2019 and famous for being. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Financial advisors can also help with investing and financial plans including retirement. It can also be used to help fill steps 3 and 4 of a W-4 form. We issue a wage attachment for 25 of gross earnings per pay period.

Wisconsin Income Tax Calculator 2021. The cost of living in Madison WI is 6 percent higher than the national average. The tax rates which range from 354 to 765 are dependent on income level and filing status.

Wisconsin Salary Paycheck Calculator. Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. The latest budget information from April 2022 is used to.

The Department of Workforce. Wisconsin Mobile Home Tax. Take home pay calculator madison wi.

The Wisconsin Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and. That means only the first 14000 of each employees pay is taxable. Your average tax rate is 1198 and your.

The first 11770 of taxable income is taxed at 4 the next. Use this calculator to help determine your net take-home pay from a company bonus. 23 rows Living Wage Calculation for Madison WI.

Take Home Pay Calculator Madison Wi. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin. A financial advisor in Wisconsin can help you understand how taxes fit into your overall financial goals.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Simply enter their federal and state W-4. The average salary in Madison WI is 69k.

Wisconsin state income tax is a graduated tax which means that the percentage of tax owed increases as income increases. Just enter the wages tax withholdings and other information required. The taxable wage base for unemployment insurance in Wisconsin is 14000 for 2022.

Wisconsin Payroll Tools Tax Rates And Resources Paycheckcity

Wisconsin Salary Paycheck Calculator Gusto

Paycheck Calculator Take Home Pay Calculator

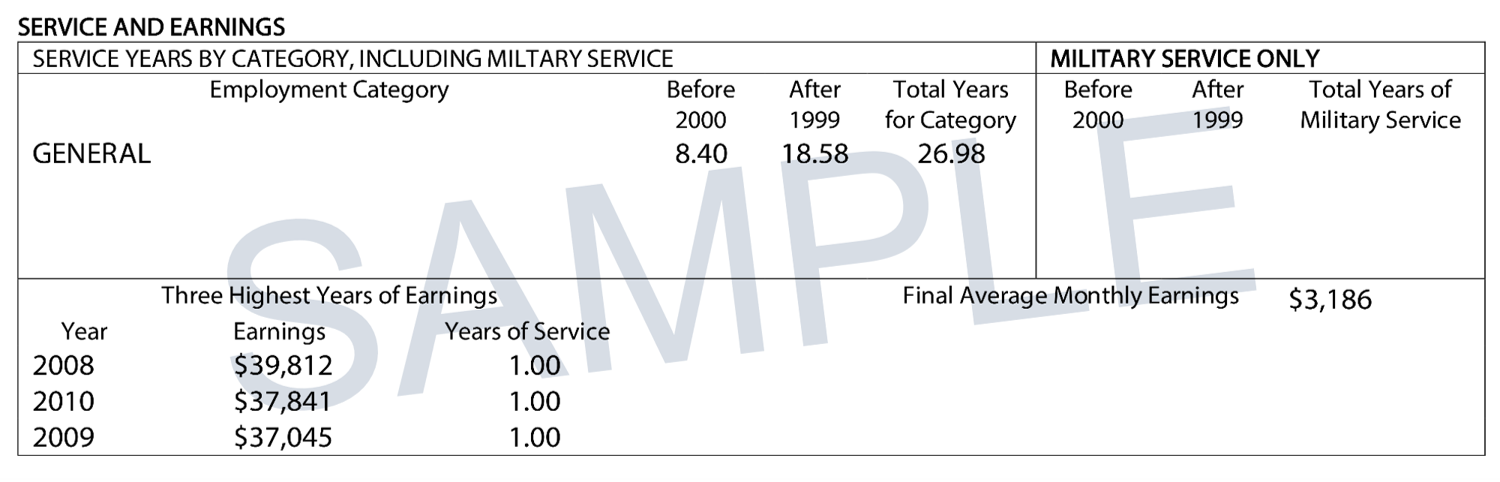

How To Fill Out Your Retirement Benefit Estimates And Application Etf

Cost Of Living Calculator Ramsey

Home Buying Closing Costs Calculator American Family Insurance

Salary Paycheck Calculator Payroll Calculator Paycheckcity

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Wisconsin Income Tax Calculator Smartasset

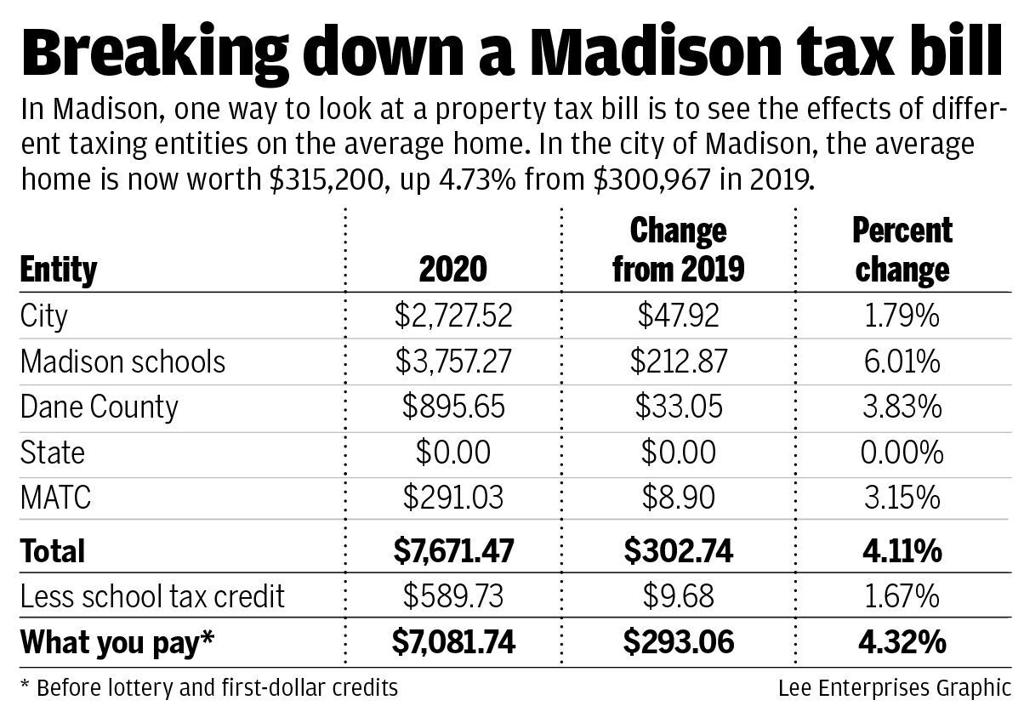

Many Dane County Homeowners Seeing Higher Property Tax Bills

Citizens Climate Lobby Madison Wi Area Home Facebook

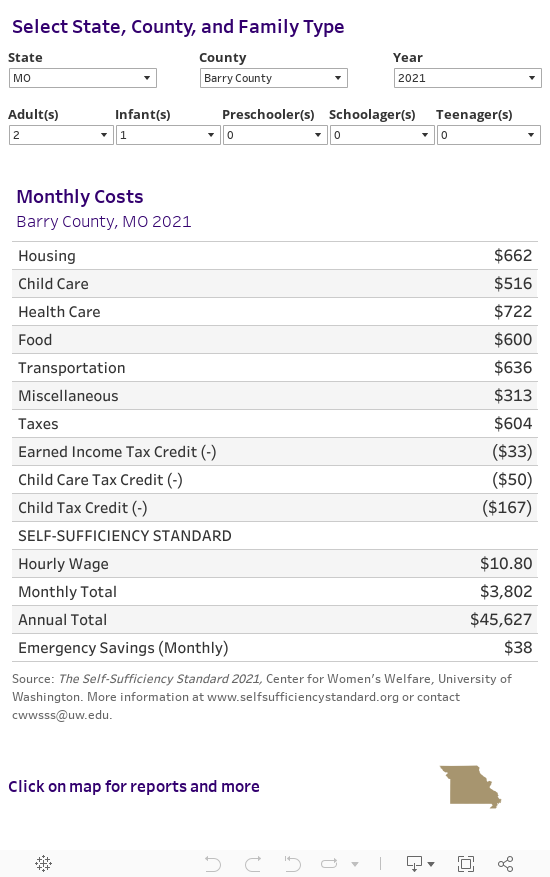

Calculator Self Sufficiency Standard

Wisconsin Salary Paycheck Calculator Gusto

Michigan Paycheck Calculator Tax Year 2022

Your Offer Office Of Student Financial Aid Uw Madison

Salary Paycheck Calculator Calculate Net Income Adp

2022 Alimony Calculator Calculate Spousal Support Payments Divergent Family Law Wisconsin