njtaxation.org property tax relief homestead benefit

Most recipients get a credit on their tax bills. Anchor Property Tax Benefit Program.

Property Tax Relief Programs West Amwell Nj

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax.

. 2018 Homestead Benefit payments should be paid to eligible taxpayers. The Homestead Benefit program provides property tax relief to eligible homeowners. Property Tax Relief Programs.

You can get information on the status amount of your Homestead Benefit either online or by phone. Property 6 days ago You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018. Property Tax Relief Forms.

Search here for information on the status of your homeowner benefit. We will begin paying ANCHOR benefits in the late Spring of 2023. Review the information on.

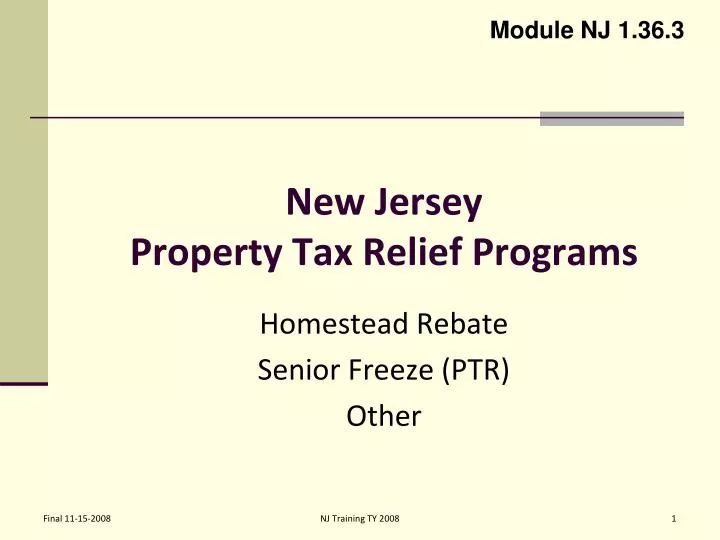

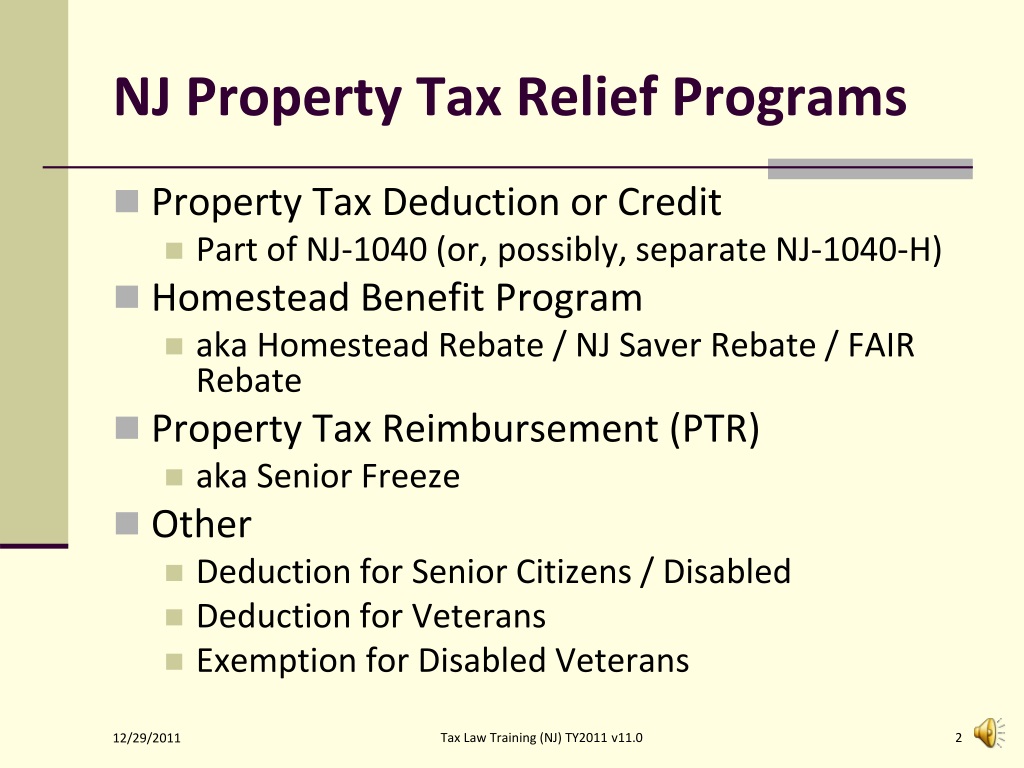

Senior Freeze Program Property Tax Reimbursement Homestead Benefit Program. Deductions Exemptions and Abatements. Applications for the homeowner benefit are not available on this site for printing.

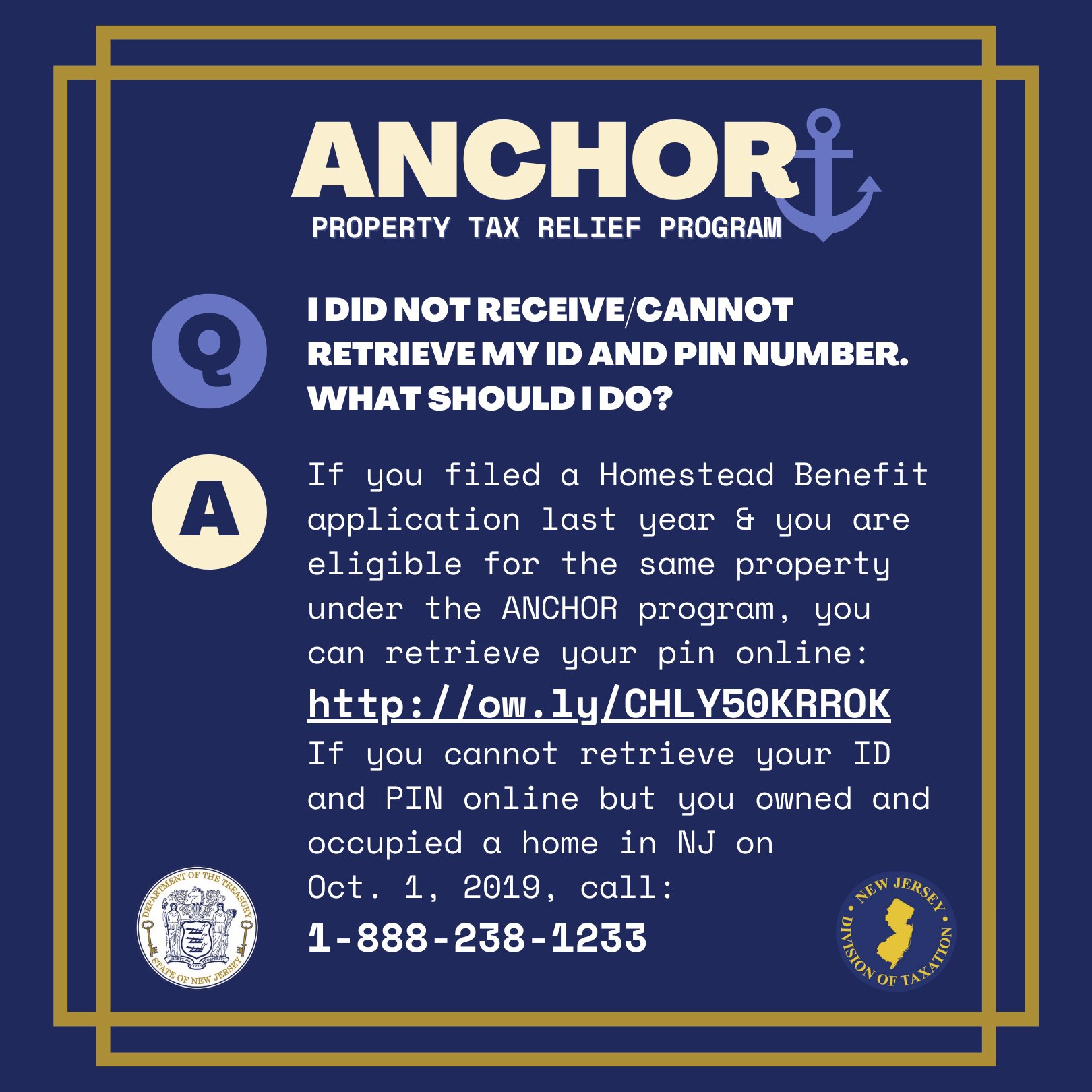

For most homeowners the benefit is distributed to your municipality in the form of a credit which. The deadline for filing your ANCHOR benefit application is December 30 2022. The filing deadline for the 2019 ANCHOR Benefit is December 30 2022.

Prior Year Homestead Benefit Calculations. File Your Homestead Benefit Online - statenjus. Applications for the homeowner benefit are not available on this site for printing.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Your benefit payment according to the Budget appropriation is calculated by. Property Tax Relief Programs.

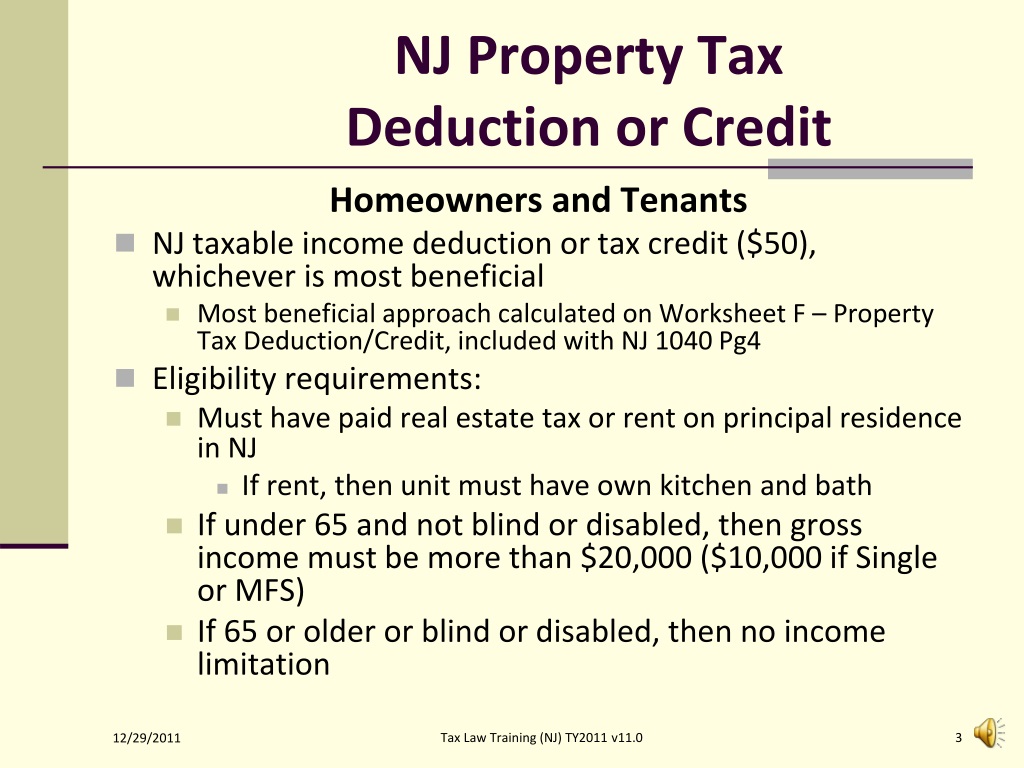

75000 for homeowners under 65 and not blind or disabled. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 -. Property Tax Relief Programs.

Property Tax Relief Forms. If your New Jersey Gross Income is. Any applications filed after this date will be considered late.

This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. If a benefit has been issued the system will tell you the amount of the benefit and the date it was.

We will mail checks to qualified applicants as. We will begin paying ANCHOR benefits in the late Spring of 2023. ANCHOR Benefit Online Filing.

ANCHOR payments will be paid in the form.

2009 Volunteer Tax Preparation Nj Division Of Taxation Ppt Download

How To File For Property Tax Relief Mercerme

Apply For Nj Anchor Tax Relief This Fall Montgomery Township New Jersey

Nj Anchor Property Tax Relief Program Replaces Homestead Benefit Middlesex Borough

![]()

2019 Anchor Property Tax Relief Program Township Of Little Falls

Space Wirths Remind Residents To Apply For Property Tax Relief Wrnj Radio

Nj Property Tax Relief Programs Mendham Borough

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 1525957

2011 Volunteer Tax Preparation Nj Division Of Taxation Ppt Download

New Jersey Governor Floats Property Tax Relief For Homeowners Renters

Nj Division Of Taxation Archived E News Mailings

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

State Of Nj Department Of The Treasury Division Of Taxation

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 1525957

Nj Dept Of Treasury Njtreasury Twitter

2011 Volunteer Tax Preparation Nj Division Of Taxation Ppt Download

State Homestead Rebate Applications In The Mail Due November 30 News Tapinto