georgia personal property tax exemptions

Pay Property Taxes Property taxes are paid annually in the county where the. 1266 E Church Street Suite 121 Jasper GA 30143.

Georgia Sales Tax Small Business Guide Truic

Inventory Tax Exemption Business inventory is exempt from state property taxes as of January 1 2016.

. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. Residents of a home valued at 10000 or less are exempt from paying property taxes if they. Ad Download Or Email Form PT-50P More Fillable Forms Register and Subscribe Now.

Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of trade. You can use our free Georgia income tax calculator to get a good estimate of what your tax liability will be come April. The average family pays 187600 in Georgia income taxes.

Georgia Individual Income Tax is based on the taxpayers federal adjusted gross income adjustments that are required by Georgia law and the taxpayers filing requirements. There are several property tax exemptions in Georgia and most. Almost all 93 percent of Georgias counties and over 140 of the cities have adopted a.

You can file a homestead exemption application any time of the year with your county tax commissioner or county board of tax assessors but it must be filed by April 1 to be in effect. Georgia exempts a property owner from paying property tax on. The office will reopen Monday October.

The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the ballot in Georgia on November 3 1964 as a legislatively referred constitutional. The home of each resident of Georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from state county and school taxes except. D Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of 1986 and held.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Savannah Office Closed Friday Due to Tropical Storm. Ad Download Or Email Form PT-50P More Fillable Forms Register and Subscribe Now.

Click here or call 706-253-8700 for Personal Property Tax Exemption Information at Pickens County Georgia government. All business personal property assets must be reported but some types of tangible personal property are not taxed including most types of automobiles trucks and other licensed. April 2 April.

The Savannah Regional Office will be closed Friday September 30 due to Tropical Storm Ian. Complete Edit or Print Tax Forms Instantly. Property Taxes While the state sets a minimal property tax rate each county and municipality sets its own rate.

Many Georgia counties and municipalities exempt local property tax at 100 for manufacturers in-process or finished goods inventory held for 12 months or less. Find out with Ballotpedias Sample Ballot Lookup tool Georgia Personal Property Tax Exemptions Amendment 14 1964 From Ballotpedia. The exemption amounts for late filed applications and supporting documentation are as follows.

To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. The Freeport filing date for 100 percent exemption is January 1 through April 1. The median property tax rate in Georgia is 907 per 100000 of assessed property value.

Ad Access Tax Forms.

Ga Dor St 5 2016 Fill Out Tax Template Online Us Legal Forms

Gsccca Org Pt 61 E Filing Help

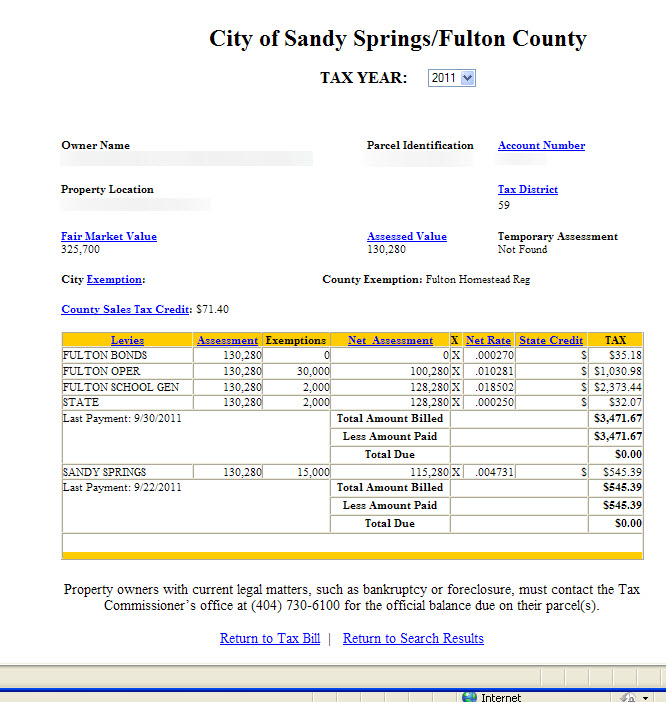

Understanding Your Property Tax Bill Department Of Taxes

Georgia Department Of Revenue Caveat 2010 Mav For Personal Property Expanded Freeport Inventory Elimination Of Ad Valorem Tax On Business Inventory Heavy Ppt Download

Are There Any States With No Property Tax In 2022 Free Investor Guide

Georgia Sales And Use Tax Exemption

How To File For Homestead Exemption In Georgia 2017 Youtube

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Why School Taxes Rise Faster Than County Taxes

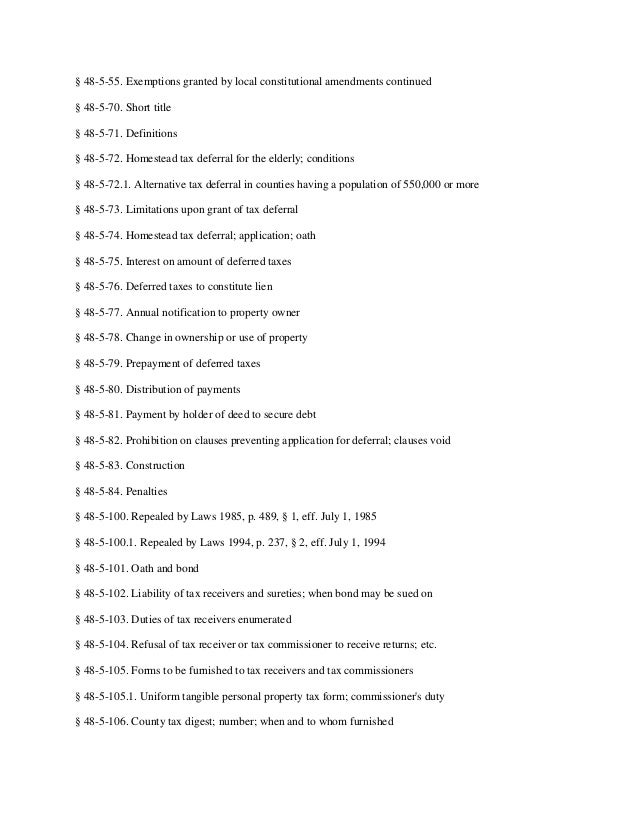

Georgia Code Title 48 Chapter 5 With Counties And Cities Listed

Property Tax Calculator Smartasset

Tax Commissioner S Office Douglas County Ga

Tangible Personal Property State Tangible Personal Property Taxes

2021 Carter Assessment Pdf Property Tax Public Finance

Property Tax Calculator Smartasset

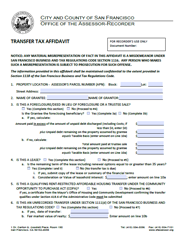

Transfer Tax Affidavit Ccsf Office Of Assessor Recorder

Form St 4 Fillable Out Of State Dealer Exemption Certificate Rev 12 01